SIMBA INVOICE

Simba Invoice has been verified by the General Department of Taxation to meet the requirements on creating, issuing, managing, and securing invoices in accordance with Decree 51.

See also self-billing software review of the General Department of Taxation

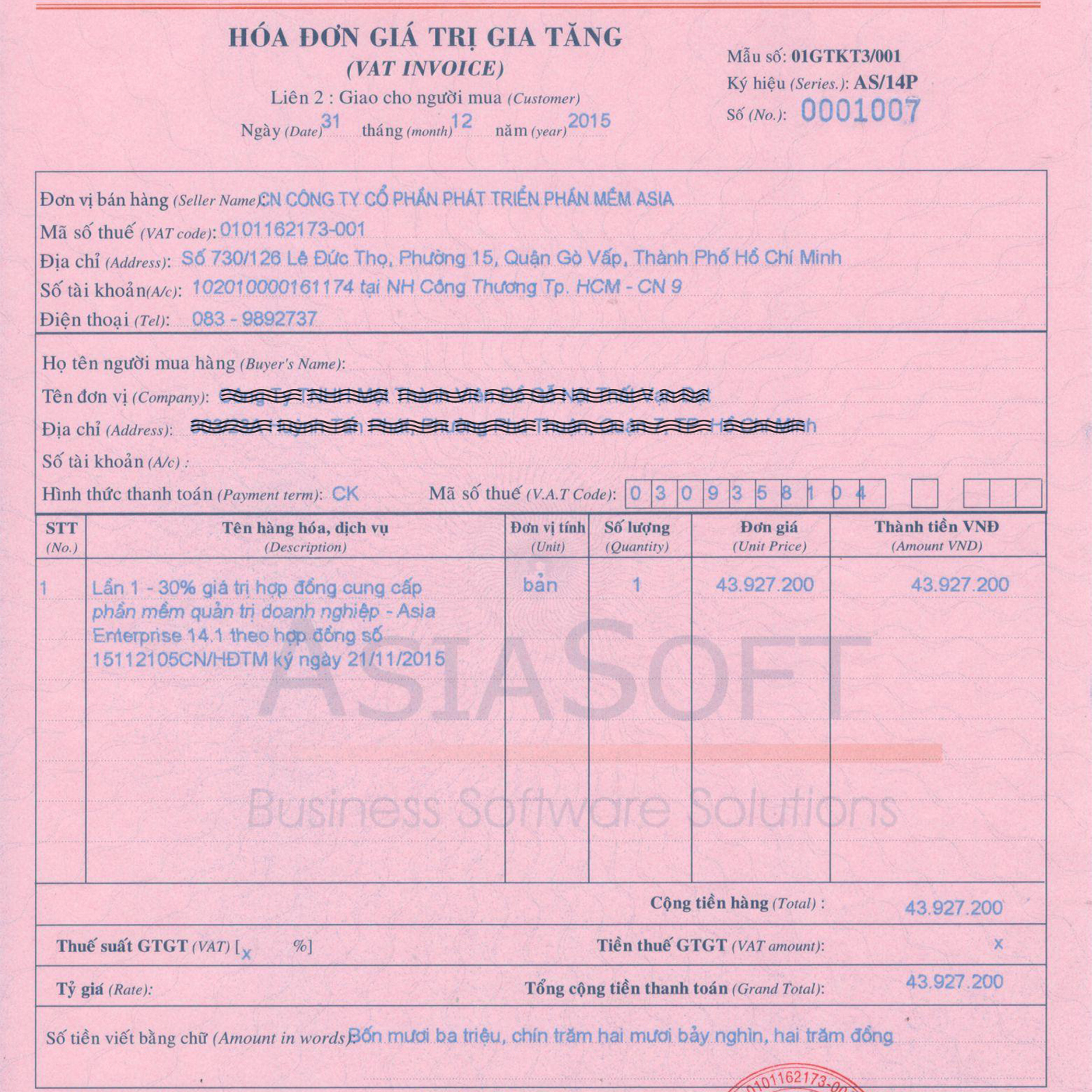

- VAT Self-Billing (Software Direct Print)

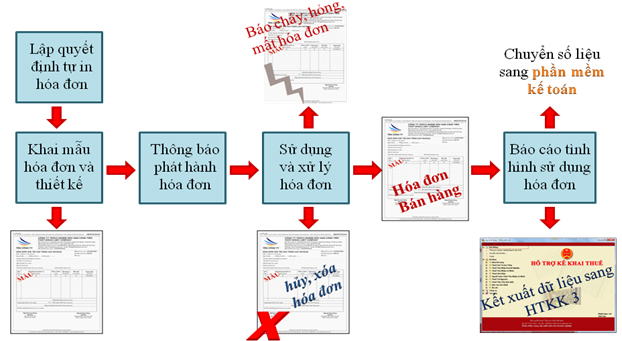

Simba Invoice has adopted a specific process and full set of functions and forms as required by taxation authorities (reviewed by the General Department of Taxation on 11/5/2011) as follows:

- Prepare a self-billing decision: Self-billing decision is prepared in Form 5.8 - Appendix 5 issued together with Circular No. 153/2010/TT-BTC dated 28/09/2010 of the Ministry of Finance

- Prepare an invoice issuance notice: Invoice issuance notice is prepared in the form issued together with Decision No. 2905/QD-BTC dated 09/11/2010

- Generate invoice form, invoice number, invoice code, print format, enterprise details to be printed with issuance information

- Prepare invoice contents from the software

- Manage invoices: created, not created, printed, print copy, etc.

- Manage and assign rights to each user

- Inquire the relevant history of printing, editing, or deleting invoices

- Each invoice is printed with a check code set by the user. Software will provide tools to support the user in checking the invoice to prevent from invoice fraud such as impersonation, fake invoice, etc.

- Report loss, damage, deletion, or cancellation, and report invoice usage and detailed statistics of the invoice

- Prepare a report on the use of invoices

- Prepare a statement and declaration directly on Simba Invoice

- Export data to declaration support software

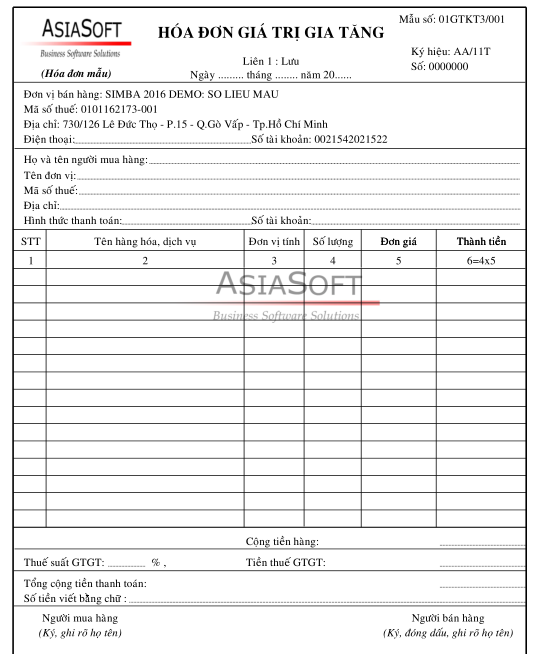

- Fill-in Invoice Print (Samples of Print Order Invoices)

- In addition to VAT Self-Billing format, Simba Invoicealso supports VAT fill-in invoice print. This print format applies to enterprises that are ineligible for VAT self-billing.

- Simba Invoice provides samples of fill-in invoices and print order invoices for enterprises to fill in instead of preparing a handwritten invoice.

For a print invoice to be standard and stable, the enterprise must have a matrix printer

- Include available samples of invoices, such as: Sales Invoice, VAT Invoice, Internal Delivery Note, Agent Delivery Order. The user can easily edit its unique forms by such actions as insert an image, insert a logo, rename the title, change the signature, edit contents that are not required, or insert the slogan of its enterprise.

- Move data to declaration support software

- Move data to SIMBA accounting software

Update to both print invoices and manage finance & accounting matters (accounting software integrated with invoice print feature in accordance with Decree 51)

|

SIMBA INVOICE PRODUCT & SERVICE PRICE LIST |

||

|

Product code |

Description of products & services |

Unit price |

|

SIMBA INVOICE |

Software that prints VAT invoices in ND 51 form |

2,500,000 |

|

Associated services (free of charge) |

- Installation, advice, and instructions on how to use for 1 sessions at offices of the enterprises (HCMC, Da Nang, Hanoi) - Support with design of VAT invoice samples by filling in the blank - 12-month warranty (Unlimited term of use for software) |

Including |